Learn How to Measure Customer Retention: Top Metrics and Tips

Last updated: January 10, 2025

Attracting new clients is an important goal for your business and retaining them is essential for its growth.

By monitoring customer retention metrics like purchase frequency and the time between purchases, you can pinpoint the ideal moments to engage clients to keep them coming back.

So, how do you boost client loyalty while measuring the impact of your efforts? Below are 10 essential metrics to track, along with valuable tips to improve your retention numbers.

What is customer retention?

Customer retention refers to the rate at which customers continue to do business with a company over a specific period.

Tracking retention for fitness & wellness businesses can reflect how loyal your client base is and how successful your business is over time.

Why measure customer retention?

In the fitness and wellness industry, customer retention is especially important because long-term client relationships are essential for sustained growth.

For example, a yoga studio or gym can't thrive by relying solely on new sign-ups—it's the loyal members who return for classes or services that generate steady revenue.

High retention rates reduce marketing costs (since retaining customers is cheaper than acquiring new ones), provide more predictable revenue, and strengthen community bonds.

By focusing on customer retention, businesses can build a loyal client base, which often leads to referrals and even greater stability and revenue growth.

Key customer retention metrics to track

Here are 10 essential retention metrics to help you focus on strategies for increasing your loyal client base and encouraging repeat visits to your business.

1. Customer retention rate

Customer retention rate measures the percentage of clients a business retains over a specific period.

Why is it important?

Your customer retention rate reflects the ability of your company to keep its existing clients and is essential for understanding clients' loyalty. This data can help you identify areas for improvement and plan your next move, such as introducing new classes during peak workout hours to boost retention.

How to calculate it

Calculating the customer retention rate is straightforward and can be done using the following formula:

![Customer Retention Rate = [(number of customers at the end of the period - number of new customers acquired during the period) / number of customers at the start of the period] x 100](/sites/default/files/public/styles/scale_735_width/public/2024-11/formula-graphics-customer-retention-rate-no-icon.png.webp?itok=jgruGAjG)

For example, let's say a fitness center started the year with 200 members. Over the year, they acquired 50 new members, but by the end of the year, they had 180 members due to some membership cancellations.

- Customer Retention Rate = [(180 - 50) / 200] x 100 = 65%

In this example, the fitness center has a customer retention rate of 65%, indicating that 65% of their initial members continued their membership throughout the year.

How to improve customer retention rate

Focusing on improving the client experience at your business is the best way to ensure a rise in your customer retention rate. You can enhance client satisfaction by ensuring that your staff is well-trained, offering a variety of high-quality services, and maintaining a relationship with clients with consistent follow-ups.

Pro tip: You can use Mindbody's retention report to track customer retention at your studio. It generates a list of new clients and regular attendees, showing retention trends over a selected date range. This tool is ideal for evaluating the success of promotions or loyalty programs and identifying which staff members attract the most returning clients.

2. Net Promoter Score

You have probably encountered this question before: "On a scale from 0 to 10, how likely are you to recommend [company name] to a friend?" The responses to this straightforward question are used to calculate your Net Promoter Score (NPS).

Why is it important?

The Net Promoter Score is a simple yet effective way to gauge your clients' feelings toward your business and convert those sentiments into measurable data.

How to calculate it

The formula for NPS is:

Promoters are clients who rated you a 9 or 10, while detractors are those who gave a score of 6 or lower.

Let's say your business receives 100 responses with the following distribution:

Scores of 9-10 (promoters): 60 clients

Scores of 0-6 (detractors): 20 clients

- Net Promoter Score = 60 promoters - 20 detractors = 40

However, whether an NPS is considered good or bad isn't as straightforward as its formula suggests; NPS varies across industries and it can be influenced by external factors such as economics and politics.

How to improve your Net Promoter Score

One way to improve your Net Promoter Score (NPS), is to actively solicit and apply feedback from your clients. Use their insights to identify areas for improvement, whether that means refining your products or services or personalizing the client experience. Aim to find ways to show your clients that you value their opinions.

3. Customer growth rate

Customer growth rate refers to the percentage increase in the number of customers a business has over a specific period, typically measured monthly or annually.

Why is it important?

This metric can help you understand how effectively you are attracting new clients and retaining existing ones. It is a critical indicator of your company's performance, and whether you are expanding your customer base and reaching new segments or markets. A positive customer growth rate suggests that your business is successfully appealing to consumers and enhancing your reputation, while a stagnant or negative rate may indicate underlying issues with your products or services that need addressing.

How to calculate it

To calculate your customer growth rate, use the following formula:

![Customer Growth Rate = [(new customers - lost customers) / total customers at the beginning of the period] × 100](/sites/default/files/public/styles/scale_735_width/public/2024-11/formula-graphics-customer-growth-rate-no-icon.png.webp?itok=kACnQ8dg)

For example, if a business had 1,000 customers at the start of the year, gained 400 new customers, and lost 100 customers over that period, the calculation would be:

- Customer Growth Rate = [(400 - 100) / 1,000) × 100 = (300 / 1,000) × 100] = 30%.

This indicates a 30% growth in the customer base for that year.

How to improve customer growth rate

Improving the customer growth rate involves, among other things, implementing effective marketing strategies. Your business can focus on targeted marketing campaigns, for example, you can use intro offers to attract new clients while leveraging social media and utilizing data analytics to understand client preferences and behaviors.

Pro tip: Mindbody's Retention Management report displays demographic data for all your repeat clients so you can access and export information like birthday, gender, how long they've been a member at your business, date of last visit, how many visits year-to-date over the past 30, 90, and 365 days and more. Demographic data enables your company to develop personalized messaging and offerings, allowing you to adapt your services to meet evolving customer needs and attract new clients.

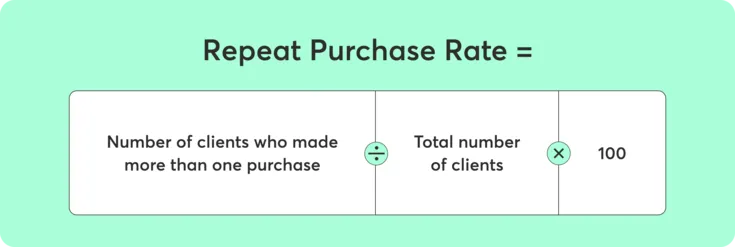

4. Repeat Purchase Rate

The repeat purchase rate measures the percentage of clients who make more than one purchase within a specified period.

Why is it important?

This metric helps your business assess client loyalty and can inform marketing strategies to encourage repeat purchases. It also helps you predict revenue stability and plan future investments or expense reduction.

How to calculate it

To calculate the repeat purchase rate, you can use the following formula:

Let's say a wellness center had 200 unique clients in the last six months, and 50 of those clients made repeat purchases, e.g., bought a second membership or attended more classes.

Using the formula:

- Repeat Purchase Rate = (50/200) × 100 = 25%

Thus, the repeat purchase rate for this wellness center is 25%, indicating that 25% of their clients are returning for additional services or products.

How to improve repeat purchase rate

Target clients who haven't made a second purchase. Consider introducing a loyalty program that rewards multiple bookings or offer a discount on their next visit to incentivize quicker returns.

Pro tip: Mindbody appointment reminders on the Retention Marketing Dashboard can help you avoid no-shows and improve repeat purchase rates. You can send emails and text messages to your clients to ensure they don't forget their next appointment. This helps them organize their schedules while making it more convenient to maintain a regular routine, leading to higher repeat purchases.

5. Customer Satisfaction Score

The Customer Satisfaction Score (CSAT) measures how happy a client is with your product or service. Clients rate their experience on a scale from 'extremely dissatisfied' to 'extremely satisfied'. While CSAT is similar to Net Promoter Score (NPS) in that both metrics gauge clients' sentiment, CSAT specifically measures satisfaction with individual interactions or purchases, whereas NPS assesses overall loyalty through clients' likelihood to recommend your brand.

Why is it important?

A high Customer Satisfaction Score allows businesses to benchmark their performance against competitors and identify areas needing improvement to allocate resources more effectively. Additionally, it boosts employee confidence by demonstrating how their efforts positively impact client satisfaction. Higher satisfaction levels lead to repeat business and referrals.

How to calculate it

Let's say you conducted a survey with 100 customers and 80 of them reported that they were satisfied or extremely satisfied with your service.

Using the formula:

- Customer Satisfaction Score = (80 / 100) × 100 = 80%

How to improve Customer Satisfaction Score

Regularly review and analyze feedback trends to implement necessary changes and continuously enhance your offerings. Ensure that your customer service team is well-trained and empowered to resolve issues efficiently and empathetically. Furthermore, foster a culture of open communication where clients feel valued and heard.

Track the right metrics to boost your customer retention

Get Started6. Customer Churn

Customer churn refers to the percentage of clients who stop using your company's services or products during a specific period.

Why is it important?

High churn rates can indicate dissatisfaction with your services or pricing, or they may reflect stronger competition in your market. Therefore, monitoring churn helps your business identify areas for improvement and retain valuable clients. Besides, calculating churn helps you forecast revenue decline and take proactive steps to counteract it.

How to calculate it

To calculate customer churn, you can use the formula:

![Churn Rate = [(number of customers at the start of the period - total number of customers at the end of the period)/ number of customers at the start of the period] x 100](/sites/default/files/public/styles/scale_735_width/public/2024-11/formula-graphics-churn-rate-no-icon.png.webp?itok=hR8U1wO0)

For example, consider that a wellness center has 150 clients at the beginning of the quarter. By the end of the quarter, 30 clients had canceled their memberships, which resulted in 120 clients at the end of the period.

Using the formula:

- Churn Rate = (150 - 120)/ 150 = 20%

In this example, the customer churn rate for the wellness center is 20%. This indicates that 20% of their clients are no longer using their services, highlighting a significant area for improvement.

How to reduce customer churn

Provide exceptional service and a personalized experience to your clients. Also, invite them to share feedback regularly, and use that feedback to make adjustments to your products and services to better meet their needs. Happy clients are the ones who stick around.

Pro tip: The Mindbody No Return report shows clients who are no longer coming to your business so you can focus on re-engaging them.

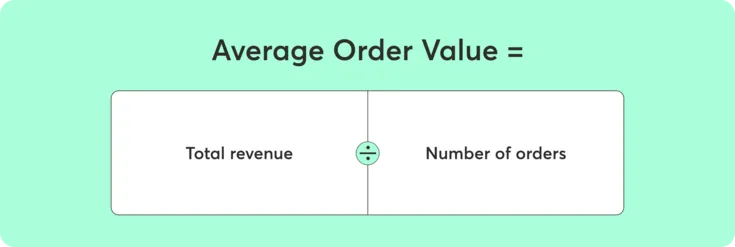

7. Average Order Value

Average order value is a key metric that measures the average amount of money spent by a client per transaction. It provides insights into client purchase behavior by showing how much, on average, each client spends every time they place an order with a business.

Why is it important?

Average order value can help you drive higher revenue without necessarily needing to attract new clients. When your clients are encouraged to spend more during each purchase, it boosts profitability and enhances your customer lifetime value (CLV). Additionally, clients who make larger purchases tend to show higher engagement and loyalty, which can contribute to better retention rates.

How to calculate it

The formula for calculating average order value is:

If a company generates $20,000 in revenue from 1,000 orders in a month, the average order value would be:

- Average Order Value = 20,000 / 1,000 => 20

This means the average client spends $20 per order.

How to improve average order value

Encourage clients to purchase higher-end products or additional items or experiences via upselling and cross-selling. Offering discounts on product bundles or class packs can motivate clients to spend more. You can also suggest products that complement what your client is already buying. For example, if you analyze a client's purchase history and identify that they regularly purchase personal training sessions, you could recommend related items such as protein supplements, workout gear, or a fitness tracker.

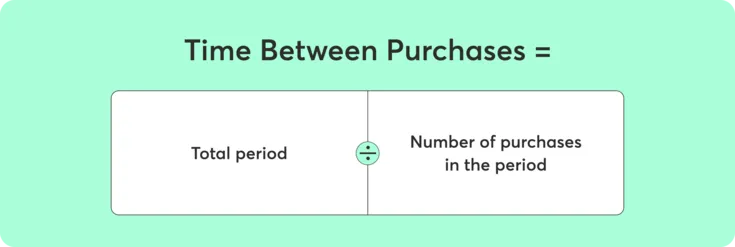

8. Time Between Purchases

Time between purchases measures the average duration between successive purchases made by a client. A shorter time between purchases often indicates high client engagement and satisfaction, while a longer interval may signal a need for re-engagement strategies.

Why is it important?

Being aware of the time between purchases helps you understand your client's behavior and tailor your communication to encourage more frequent visits.

How to calculate it

Use this formula:

Let's say a beauty salon tracks one client, Margie, who made four purchases over the year.

- Time Between Purchases = 12 / 4 = 3

In this example, the time between purchases for Margie is 3 months, indicating that she typically returns to the studio for services every three months.

If you're calculating the average time between purchases for multiple clients, simply sum up their individual times and divide the total by the number of clients.

For example, Margie's average time between purchases is 3 months, Sara's is 2 months, and John's is 4 months. To find the overall average, you would add their times together and divide the result by the number of clients: (3 + 2 + 4) / 3 = 3 months.

How to reduce time between purchases

Plan targeted promotions or reminders to encourage clients to visit more frequently. For instance, if a wellness center notices that clients typically return every three months, it can schedule targeted promotions or reminders to engage them just before that time frame.

Pro tip: Mindbody's No Return report helps you gauge how frequently clients return after their initial visit. You can use the filters to identify valuable, high-traffic clients or those who haven't returned for some time. You can tag frequent visitors to identify them in other reports and recognize trends, such as popular membership types and common client indexes.

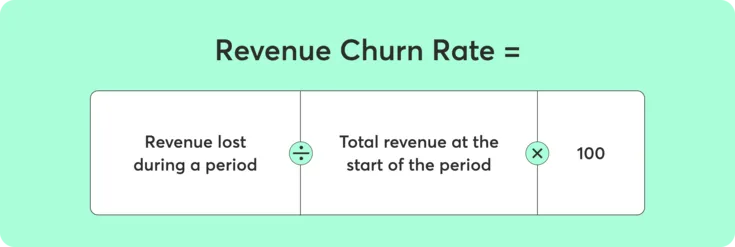

9. Revenue Churn Rate

Revenue churn rate measures the percentage of revenue lost during a specific period due to client's cancellations, downgrades, or non-renewals. It focuses on the financial impact of customer churn rather than just the number of clients who left. This metric is especially relevant for subscription-based businesses or those with recurring revenue models.

Why is it important?

Revenue churn rate directly affects your company's financial health and growth potential. While customer churn shows the number of clients you lost, revenue churn indicates the financial value of those losses. Reducing revenue churn helps maintain a steady cash flow and supports long-term business growth. High revenue churn can signal issues with your client satisfaction, pricing, or service value.

How to calculate it

The formula for calculating revenue churn rate is:

If a company had $300,000 in revenue at the start of the month and lost $10,000 in revenue from cancellations or downgrades, the revenue churn rate would be:

- Revenue churn rate = (10,000 / 300,000) × 100 = 3.33%

How to improve revenue churn rate

To improve revenue churn rate, focus on retaining high-value clients through personalized services, loyalty programs, and proactive support. Improve product or service quality, and address clients feedback to resolve issues before they lead to cancellations. Offering discounts or incentives for long-term commitments can also help reduce churn.

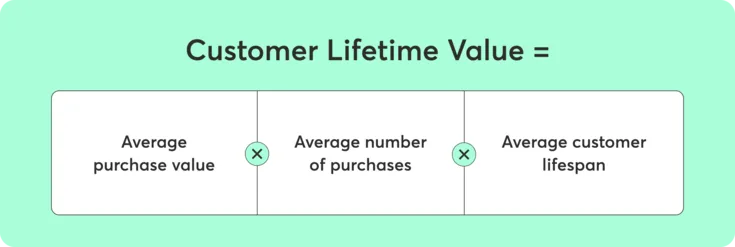

10. Customer lifetime value

Customer lifetime value estimates the total revenue a business can expect from a single customer over the entire duration of their relationship.

Why is it important?

With this knowledge, you can decide how much you can afford to spend on customer acquisition and retention without sacrificing profitability.

How to calculate it

To calculate customer lifetime value, use this formula:

Imagine that a spa's average purchase value is $100 per month. On average, clients purchase services once per month. The customer lifespan for the studio is 3 years (36 months).

- Customer Lifetime Value = 100 x 1 x 36 = 3,600

In this example, the customer lifetime value for the wellness studio is $3,600. This means that, on average, each client is worth $3,600 to the business over the course of their relationship. So, if the cost of retaining a client is lower than their lifetime value, investing in retention strategies becomes a smart and profitable choice.

How to improve customer lifetime value

One of the most important strategies to increase Customer Lifetime Value is to deliver exceptional customer service. When customers feel valued and receive prompt and attentive support, they're more likely to remain loyal to the brand and make repeat purchases.

Pro tip: Use Mindbody Visit Milestones to track your clients' visits and even create a smart list in Marketing Suite based on client visit frequency to tailor marketing messages and develop incentives that help them reach their next milestone. This will increase client satisfaction and boosts customer lifetime value by keeping them engaged and committed to your services over the long term.

Measure customer retention for ongoing growth

Customer retention isn't just about keeping clients; it's about fostering long-term relationships that increase your profitability, reduce acquisition costs, and create brand advocates.

As you fine-tune your approach based on the above metrics, you'll increase client satisfaction while gaining the insights needed to stay ahead in an increasingly competitive market.

By continually measuring, analyzing, and optimizing client retention, your business can thrive and become a leader in the wellness industry.